Starting January 1, 2024, the Corporate Transparency Act (CTA) introduces a new federal reporting requirement impacting many business entities. If you operate a Limited Liability Company (LLC), an LLC taxed as an S-Corp, a Corporation, or other entities registered with the Secretary of State, this law now mandates you to disclose specific personal information about your business’s […]

Category: Business/General

2023 Extension Request Due April 15, 2024

2023 Extension Request Due April 15, 2024 Please request an extension if your 2023 individual, single-member LLC, or C corporation filings will not be complete by 4/15/24. We cannot assume that you need an extension. If you are requesting an extension, remember it is an extension of time to file and not an extension of […]

S-Corp.s & Partnerships due March 15, 2024

We spring forward into daylight savings time, with several tax deadlines looming near. We share the good news of an automatic extension until June 17th, 2024 for San Diego County residents only. To request an extension, please call 310.398.3231 or 858.279.1640 or e-mail Roxana@taxplus.com . S-Corp.s & Partnerships due March 15, 2024 The S Corp tax deadline for 2023 […]

Small Business Tax Deductions Update 2024

Which small business tax deductions have changed for 2023? To start, business meals and bonus depreciation. With the new tax season upon us, you must be up to date with Small Business Deduction changes for the 2023 tax year. Small Business Tax Deductions Update 2024 Which expenses does the IRS permit you to deduct as […]

2024 Tax Update: Third-Party Payment Platforms and 1099-K Forms

As you may have heard, there have been some proposed changes to the tax reporting requirements for the use of third-party payment platforms, such as credit card processors, PayPal, Venmo, Cash App, Etsy, Stripe, Ebay, Amazon, VRBO, AirBnB, and other sites. As part of the American Rescue Plan Act of 2021, the Biden Administration has […]

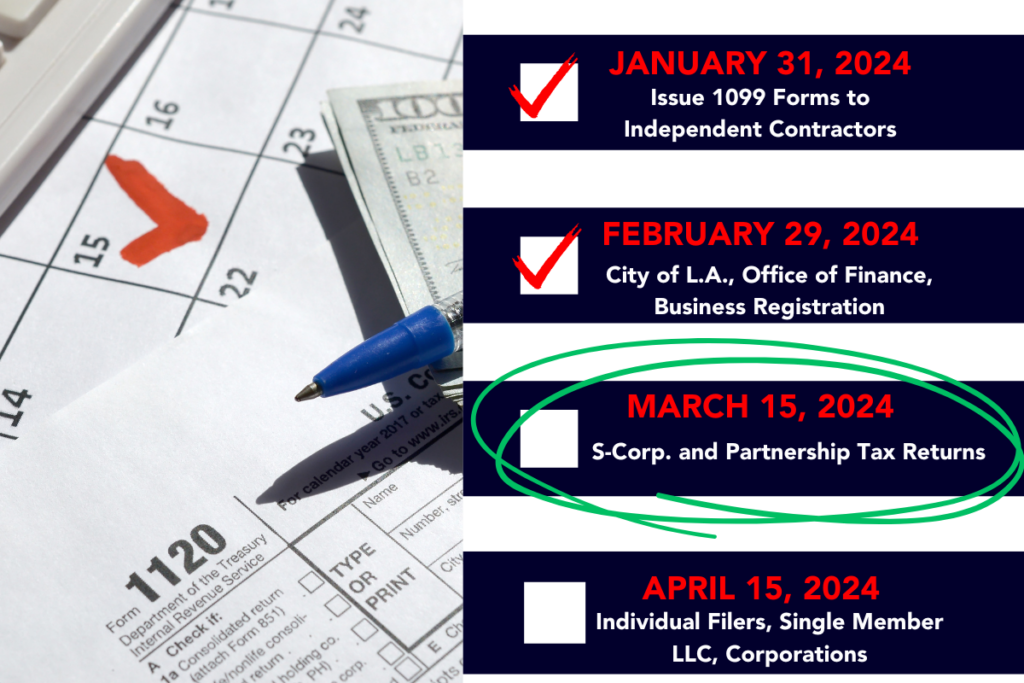

Important Tax Deadlines For 2024

It’s officially tax season here in the U.S. and here are some important tax deadlines for 2024. In addition, the IRS will officially start accepting 2023 e-filings on January 29, 2024. It’s not too soon to schedule your in-person or virtual tax appointment for your 2023 tax year preparation! Contact us with any questions, to review our virtual […]

2023 Business Entity Formation Final Call

2023 Business Entity Formation: Final Call for LLC or Corporation Whether you are ready to launch a new business idea or you have a skill or hobby that can translate into a side business, now is the time to set that up for the most effective tax benefits. The proper business entity will provide the […]

Schedule Your ’23 Tax Planning Conference

Schedule Your ’23 Tax Planning Conference There are a couple of months left to project your 2023 tax results and make tax-saving decisions, we recommend that you schedule your 2023 tax planning conference with us. Whether you simply wish to anticipate the outcome of this year’s tax filing results or to proactively mitigate taxes, late October […]

The AB-150 Pass-Through Entity Elective

Using The AB-150 Pass-Through Entity Elective If you are a Qualified Taxpayer of a Qualified Entity who routinely pays more than $10,000 in state and local taxes and more than 9.3% in California Income Taxes on your K-1 income, the Pass-Through Entity Elective Tax may be an effective tax mitigation strategy for you. In July […]

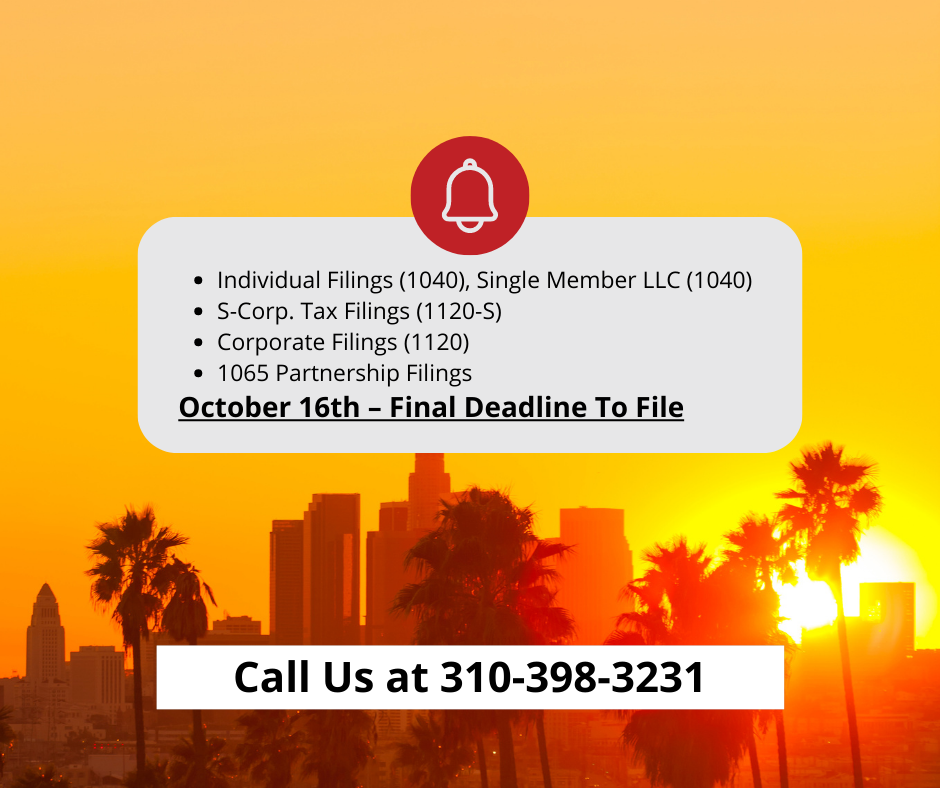

ALL EXTENDED 2022 TAX FILINGS DUE 10/16/23

ALL EXTENDED 2022 TAX FILINGS DUE 10/16/23! Eight weeks remaining! Due to the severe storm damage earlier in the year throughout CA, for those affected by the flooding, many counties were covered by a federal emergency declaration and received additional time to file and pay taxes. That extension ends on 10/16/23. There are no further […]